- Last week’s inflows into digital asset investment products totalled $326M

- Bitcoin accounted for 90% of all inflows recorded

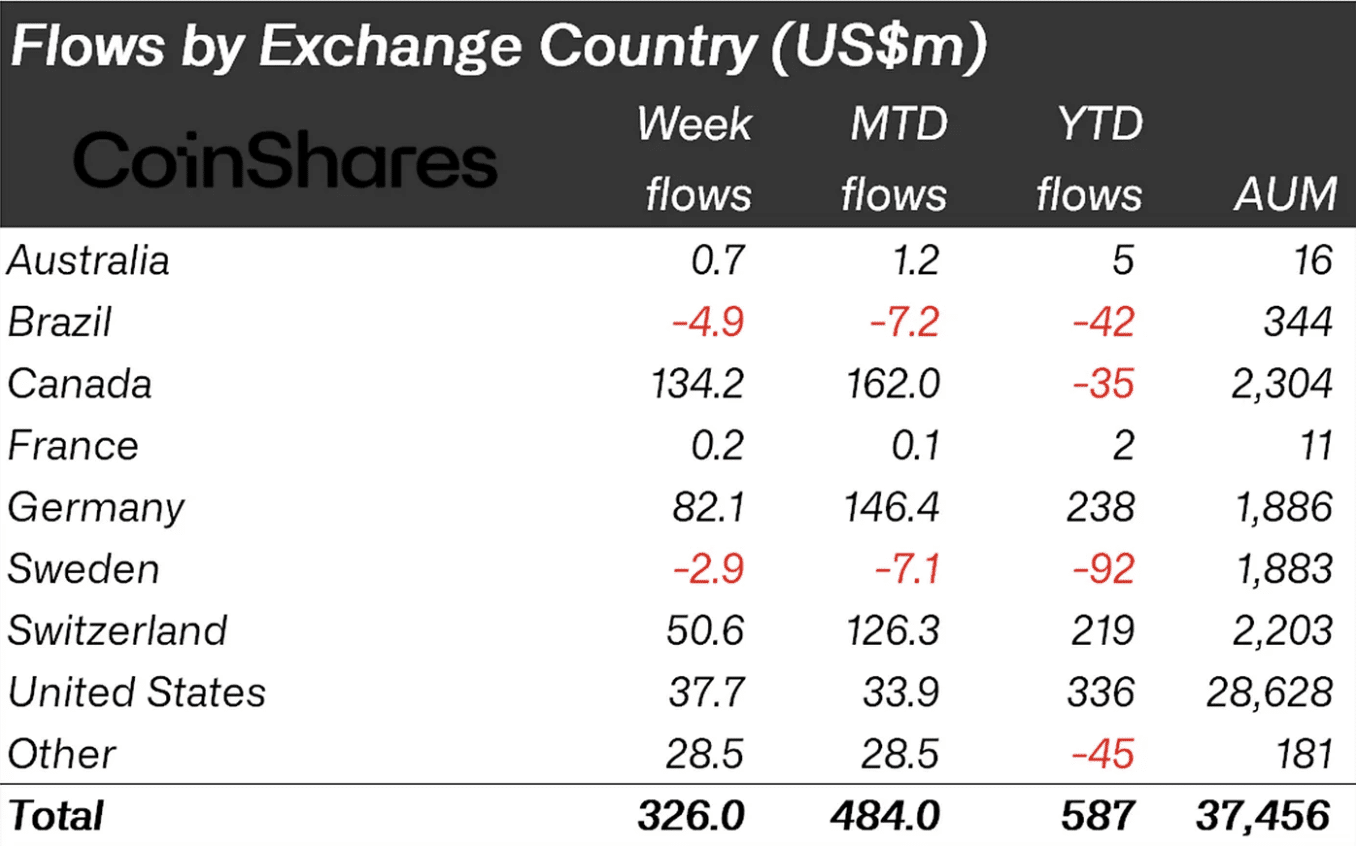

Digital asset investment products recorded inflows of $326 million last week. This represented the largest single week of inflows since July 2022, CoinShares found in a new report.

As the report highlighted, the key catalyst behind the record inflow was the optimism surrounding the potential approval of a spot-based Bitcoin ETF by the US Securities and Exchange Commission (SEC).

The bullish sentiments that enveloped the entire market in October caused crypto funds to only record inflows during the four-week period.

This brought the month-to-date flows “close to half a billion dollars”. Likewise, the total assets under management for these digital asset products reached $37.8 billion, marking the highest figure since May 2022.

On a regional level, the majority of last week’s flows into crypto funds came from Canada, Germany, and Switzerland. Investors in these countries accounted for inflows of $134 million, $82 million, and $50 million, respectively.

The United States accounted for only 12% of all inflows recorded during the same period. According to CoinShares, this suggested that U.S. investors may be holding off, possibly in anticipation of the ETF approval.

Notably, Asia recorded its highest weekly inflows at $28 million.

Bitcoin leads, others follow

With $296 million added to Bitcoin-backed investment products, the leading coin accounted for 90% of the total inflows recorded last week. This brought its month-to-date inflows to $407 million, a 263% uptick from the previous week’s inflow of $112 million.

Regarding its year-to-date (YTD) flows, last week’s fund flow pushed the coin’s net inflows above $600 million. According to CoinShares, BTC’s YTD net inflows totaled $613 million last week. In the week before, this was less than $350 million.

Interestingly, despite BTC’s positive price performance in the past few weeks, some investors added funds to short-bitcoin positions.

CoinShares found,

“Recent price rise also prompted inflows of US$15m into short-Bitcoin investment products,”

Solana remains king in the alt-verse

In the previous week, the $15.5 million recorded as inflows into Solana-backed products made it the altcoin with the most positive fund flows that week.

Repeating the same feat last week, the coin saw inflows of $24 million. This brought the coin’s month-to-date inflows to $66 million and its YTD net flows to around $100 million.

According to CoinShares:

“The improving optimism also prompted significant inflows of US$24m into Solana, while some other altcoins saw inflows this optimism did not include Ethereum, which saw another US$6m of outflows.”

- Last week’s inflows into digital asset investment products totalled $326M

- Bitcoin accounted for 90% of all inflows recorded

Digital asset investment products recorded inflows of $326 million last week. This represented the largest single week of inflows since July 2022, CoinShares found in a new report.

As the report highlighted, the key catalyst behind the record inflow was the optimism surrounding the potential approval of a spot-based Bitcoin ETF by the US Securities and Exchange Commission (SEC).

The bullish sentiments that enveloped the entire market in October caused crypto funds to only record inflows during the four-week period.

This brought the month-to-date flows “close to half a billion dollars”. Likewise, the total assets under management for these digital asset products reached $37.8 billion, marking the highest figure since May 2022.

On a regional level, the majority of last week’s flows into crypto funds came from Canada, Germany, and Switzerland. Investors in these countries accounted for inflows of $134 million, $82 million, and $50 million, respectively.

The United States accounted for only 12% of all inflows recorded during the same period. According to CoinShares, this suggested that U.S. investors may be holding off, possibly in anticipation of the ETF approval.

Notably, Asia recorded its highest weekly inflows at $28 million.

Bitcoin leads, others follow

With $296 million added to Bitcoin-backed investment products, the leading coin accounted for 90% of the total inflows recorded last week. This brought its month-to-date inflows to $407 million, a 263% uptick from the previous week’s inflow of $112 million.

Regarding its year-to-date (YTD) flows, last week’s fund flow pushed the coin’s net inflows above $600 million. According to CoinShares, BTC’s YTD net inflows totaled $613 million last week. In the week before, this was less than $350 million.

Interestingly, despite BTC’s positive price performance in the past few weeks, some investors added funds to short-bitcoin positions.

CoinShares found,

“Recent price rise also prompted inflows of US$15m into short-Bitcoin investment products,”

Solana remains king in the alt-verse

In the previous week, the $15.5 million recorded as inflows into Solana-backed products made it the altcoin with the most positive fund flows that week.

Repeating the same feat last week, the coin saw inflows of $24 million. This brought the coin’s month-to-date inflows to $66 million and its YTD net flows to around $100 million.

According to CoinShares:

“The improving optimism also prompted significant inflows of US$24m into Solana, while some other altcoins saw inflows this optimism did not include Ethereum, which saw another US$6m of outflows.”

where can i buy clomiphene pill clomiphene bula profissional clomiphene challenge test where buy generic clomid pill cost generic clomiphene without a prescription clomiphene price cvs buying clomiphene tablets

More posts like this would add up to the online time more useful.

This is the kind of enter I find helpful.

where can i buy azithromycin – order tinidazole 300mg sale buy metronidazole 200mg

order rybelsus 14mg generic – periactin 4 mg for sale order cyproheptadine 4mg generic

order motilium for sale – buy domperidone online buy flexeril 15mg pill

purchase inderal for sale – methotrexate 10mg uk buy generic methotrexate online

order augmentin 625mg online – https://atbioinfo.com/ acillin price

order esomeprazole 40mg for sale – https://anexamate.com/ order esomeprazole 20mg pill

brand warfarin 2mg – https://coumamide.com/ cozaar 50mg over the counter

meloxicam 7.5mg ca – https://moboxsin.com/ brand mobic 15mg

prednisone 10mg for sale – https://apreplson.com/ order prednisone 40mg sale

natural ed pills – https://fastedtotake.com/ cheap erectile dysfunction pill

buy amoxil no prescription – https://combamoxi.com/ amoxil ca

cost forcan – buy fluconazole 100mg for sale buy diflucan

cenforce online buy – https://cenforcers.com/# cheap cenforce 50mg

cialis dosages – best time to take cialis 5mg cialis ingredients

buy ranitidine tablets – https://aranitidine.com/ order generic zantac 300mg

cialis for daily use reviews – https://strongtadafl.com/ what does a cialis pill look like

cheap viagra and cialis – buy generic viagra new zealand viagra 50mg buy

I couldn’t hold back commenting. Profoundly written! order amoxicillin online cheap

I’ll certainly bring back to read more. ursxdol

I am actually enchant‚e ‘ to glitter at this blog posts which consists of tons of of use facts, thanks for providing such data. https://prohnrg.com/product/loratadine-10-mg-tablets/

More articles like this would pretence of the blogosphere richer. https://aranitidine.com/fr/acheter-propecia-en-ligne/

The vividness in this serving is exceptional. https://ondactone.com/spironolactone/

With thanks. Loads of knowledge!

https://proisotrepl.com/product/baclofen/

This is the make of enter I find helpful. http://mi.minfish.com/home.php?mod=space&uid=1412627

buy forxiga generic – https://janozin.com/ where can i buy dapagliflozin