- Miner capitulation and decreased stablecoin issuance are reducing crypto market liquidity.

- Significant outflows from ETFs are increasing selling pressure on Bitcoin.

The crypto market has witnessed a significant downturn, with the global market cap tumbling from over $2.8 trillion to just below $2.5 trillion in a matter of weeks.

This stark decline has rippled across the sector, affecting major cryptocurrencies like Bitcoin [BTC], which has seen a 7.9% drop in the past fortnight alone.

Market analysts have been quick to identify several factors contributing to the current market conditions.

A closer look at Bitcoin revealed that it has not only dropped by nearly 8% over the last two weeks but has also continued to struggle in the last 24 hours, shedding an additional 0.1% to trade at around $65,524.

What is behind this recent downturn?

Reasons behind the crypto plunge

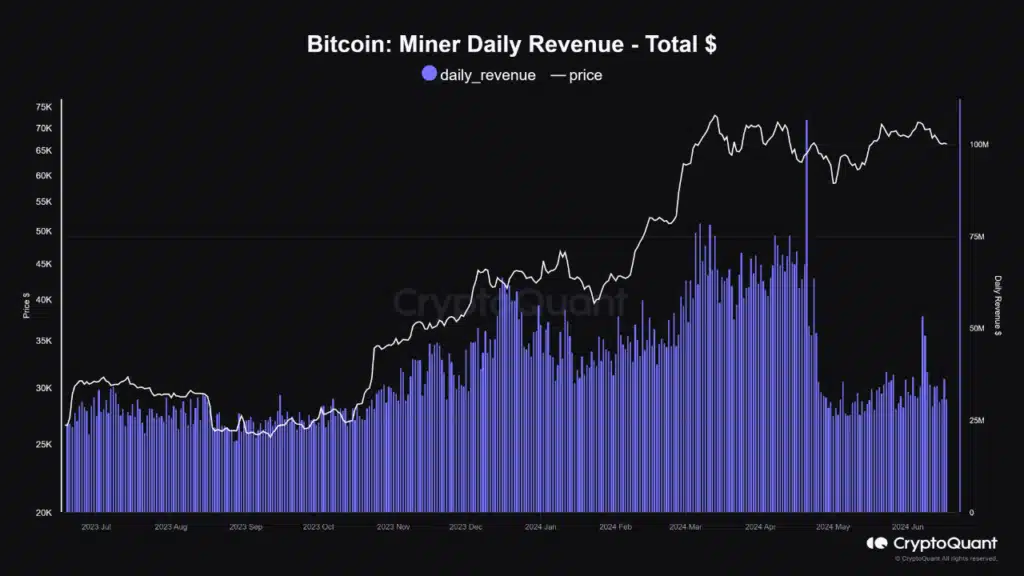

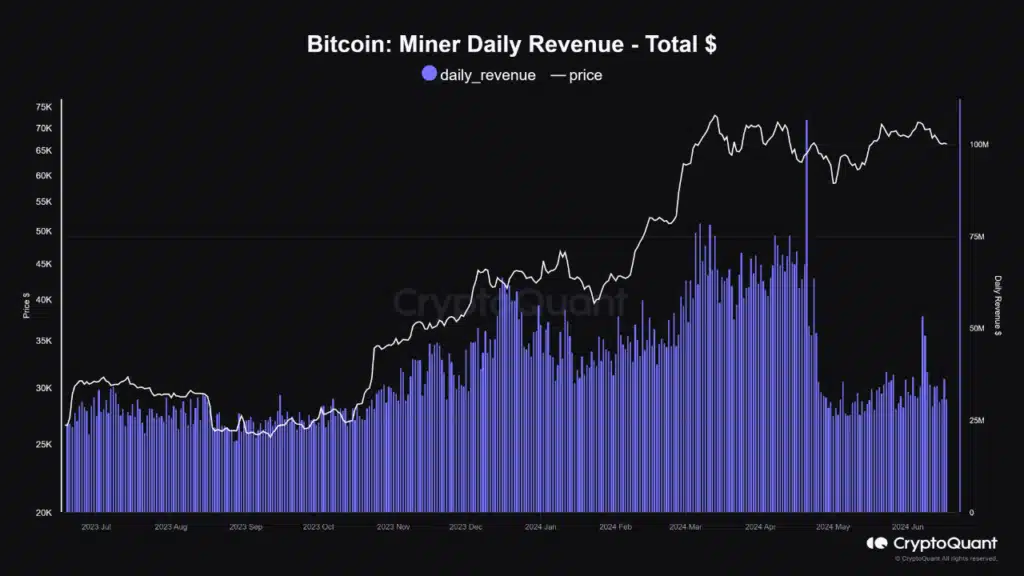

One of the primary factors the CryptoQuant analyst cited for the recent market decline is miner capitulation.

The CryptoQuant analyst points out a significant drop in miner revenues—by as much as 55%—has forced miners to offload Bitcoin to cover operational costs.

Source: CryptoQuant

This increase in Bitcoin moving from miners’ wallets to exchanges often precedes a price drop, as the market absorbs the added selling pressure.

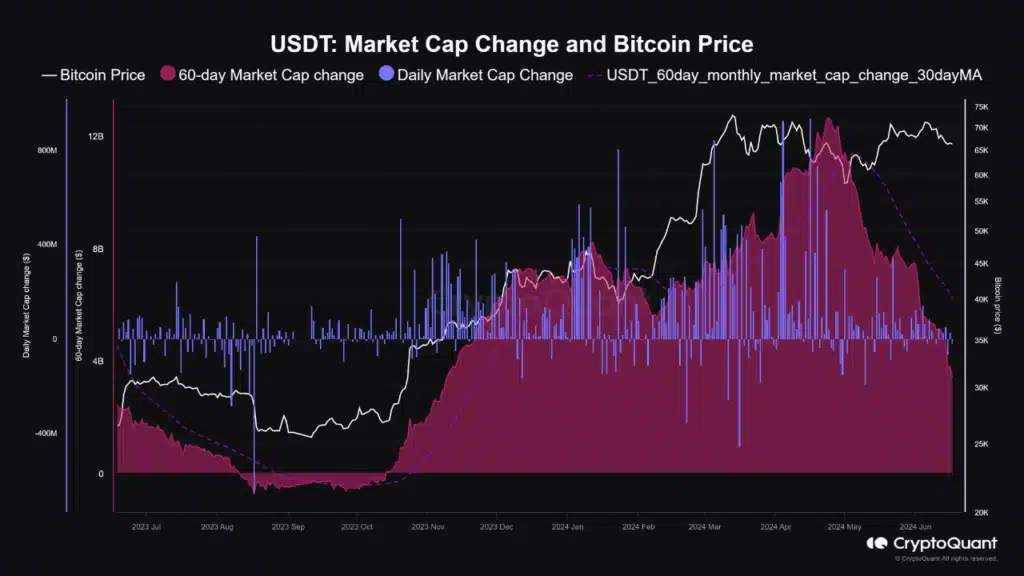

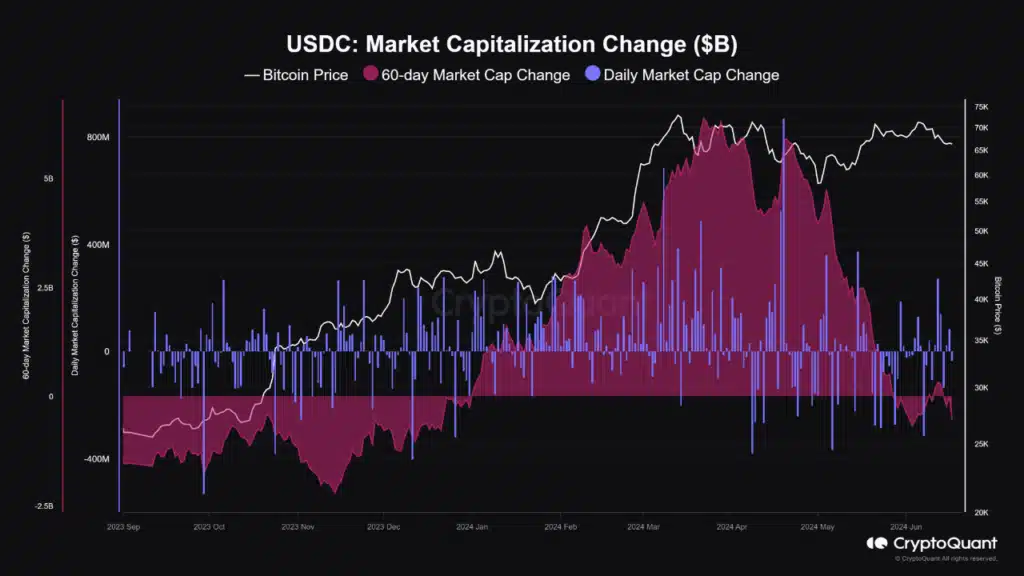

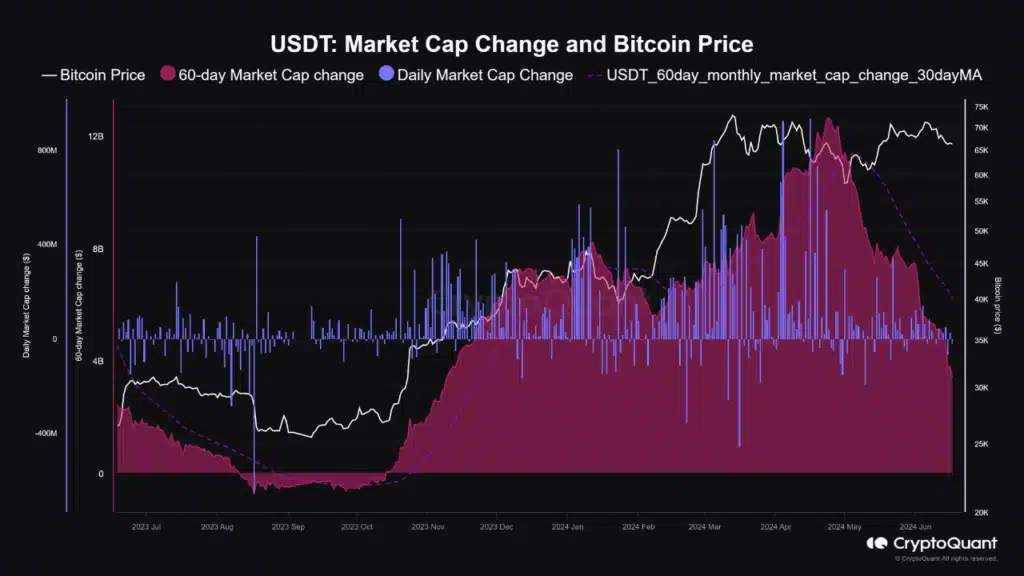

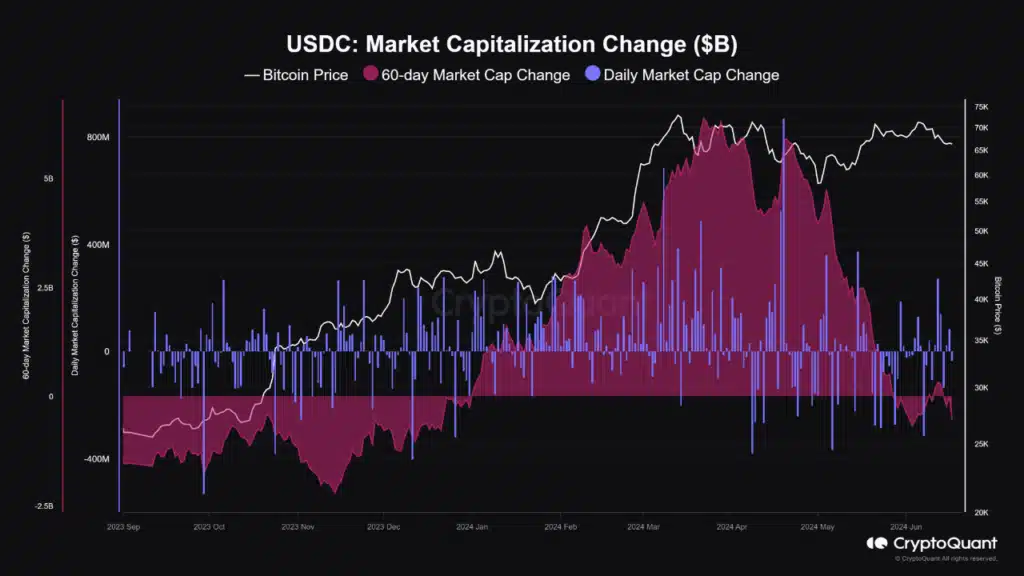

Additionally, the lack of new issuances of major stablecoins such as USDT and USDC has contributed to reduced liquidity in the market.

Normally, new issuances signify fresh capital entering the market, bolstering trading volumes and supporting price levels.

Source: CryptoQuant

However, with stablecoin issuances stalling, there’s less new money to counteract selling pressures, leading to increased volatility and price declines.

Source: CryptoQuant

Another significant pressure point comes from the outflows observed in major cryptocurrency exchange-traded funds (ETFs).

Notable withdrawals, such as the over 1,384 BTC pulled from Fidelity on the 17th of June, exemplify the selling pressures that weigh heavily on Bitcoin prices.

These withdrawals reflect a broader sentiment of caution among crypto investors, particularly in response to the uncertain macroeconomic landscape.

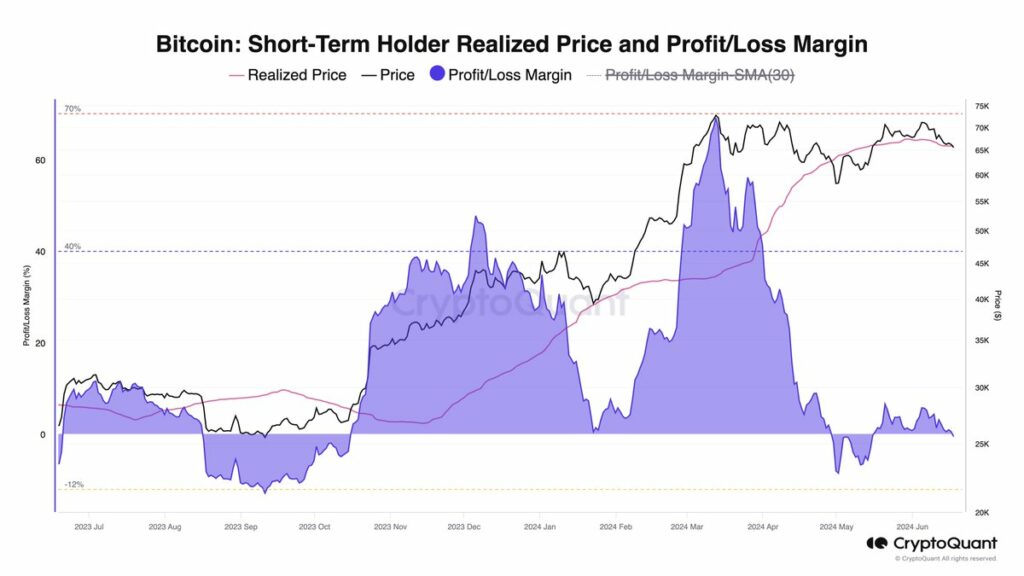

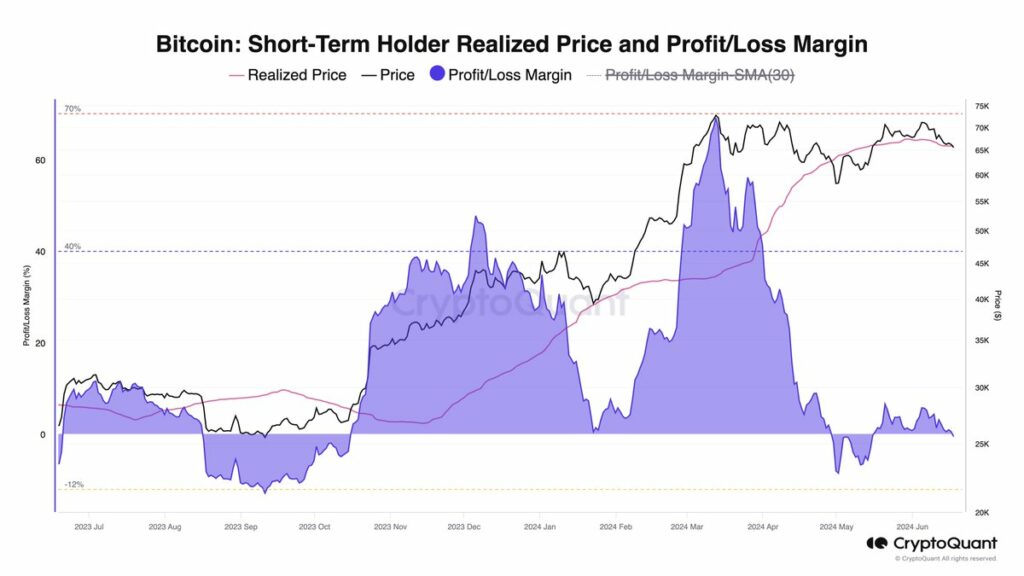

The selling behavior is not isolated to institutional investors; it extends to short-term holders as well.

The Spent Output Profit Ratio (SOPR) for this group has not reached the highs typical of market peaks, suggesting that we are not at a cycle top yet.

Instead, we’re seeing a market still dominated by long-term holders, providing a strong support level that could temper a further crypto drop.

Looking ahead

Despite the current downturn, there are indicators that the market might be nearing a bottom.

Another CryptoQuant analyst, Julio Monero, highlighted on the X (formerly Twitter) platform that Bitcoin has fallen below key short-term support levels, potentially indicating a further drop to around $60,000.

Source: CryptoQuant

Factors such as subdued activity from traders and large investors, coupled with limited liquidity from stablecoins and diminished U.S. investor interest, are currently dampening crypto market dynamics.

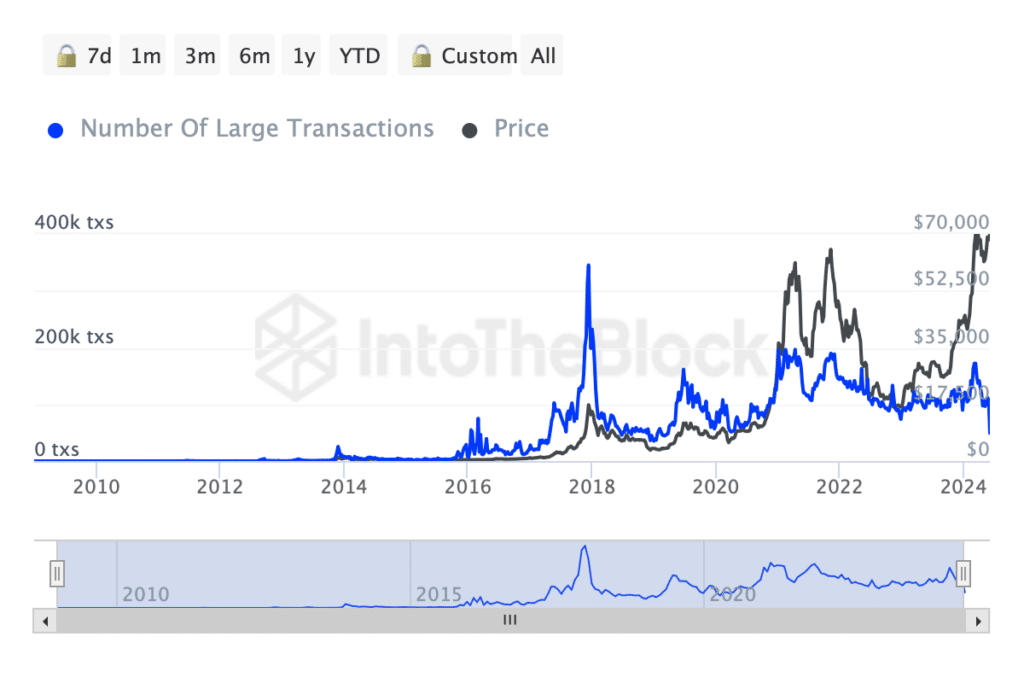

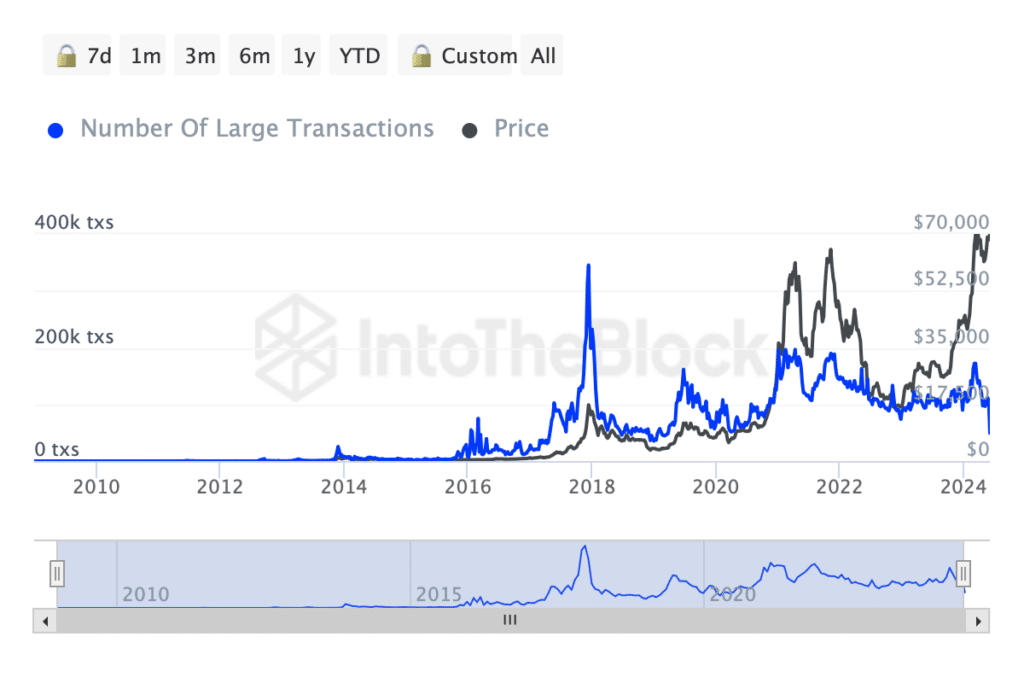

Further examination using IntoTheBlock’s data revealed a notable uptick in Bitcoin transactions exceeding $100,000, signaling increased activity from large-scale investors, which could foreshadow a shift in market momentum.

Source: IntoTheBlock

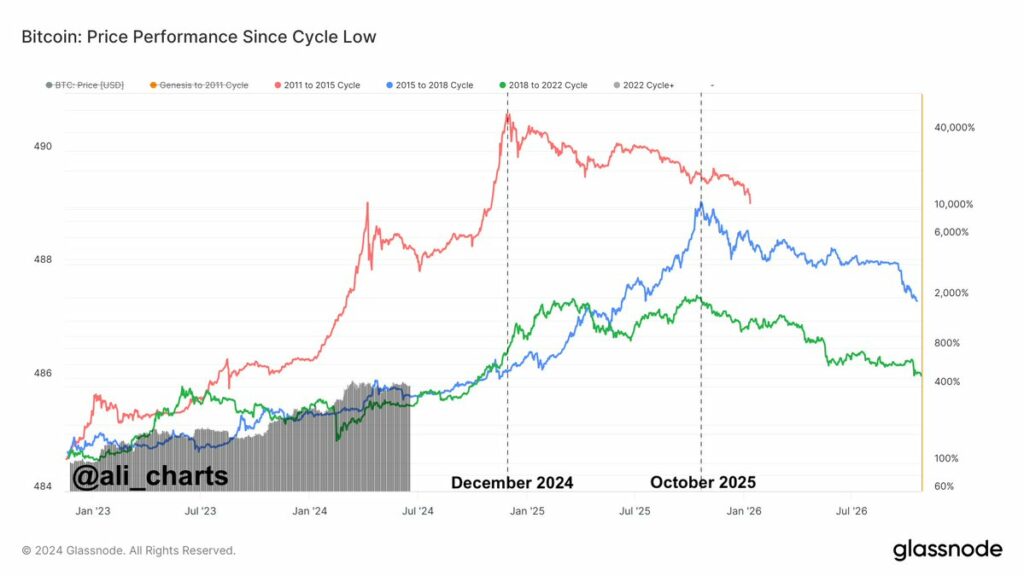

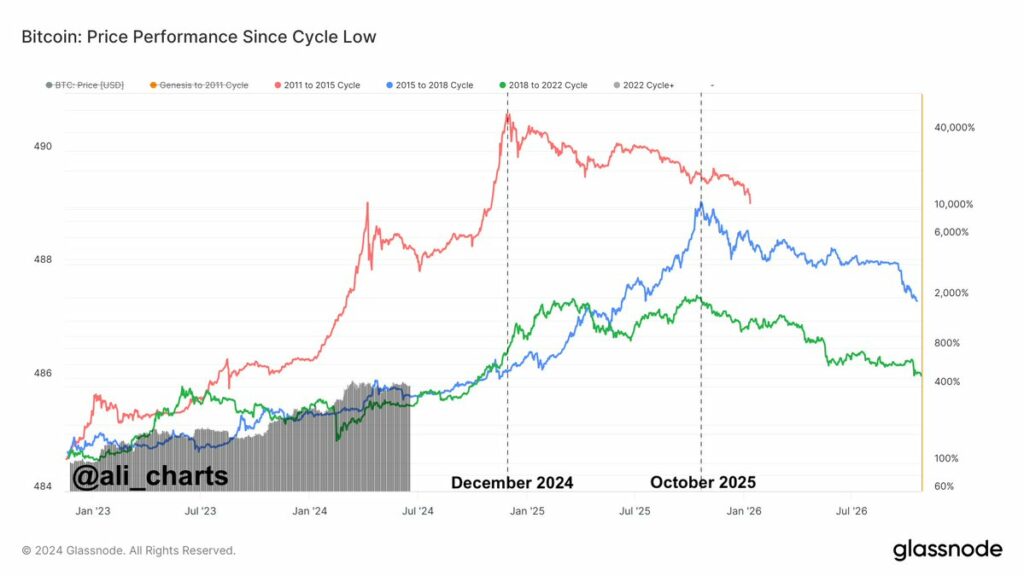

Prominent crypto analyst Ali, analyzing Bitcoin’s historical price trends, suggested that if the current market cycle follows previous patterns, we might not see a peak until late 2024 or 2025.

Source: Ali Charts on X

Read Bitcoin’s [BTC] Price Prediction 2024-2025

This analysis was shared alongside a chart illustrating Bitcoin’s performance from its most recent cycle low.

Meanwhile, according to AMBCrypto’s recent report, regardless of all these downturns, we are still in a crypto bull market.

- Miner capitulation and decreased stablecoin issuance are reducing crypto market liquidity.

- Significant outflows from ETFs are increasing selling pressure on Bitcoin.

The crypto market has witnessed a significant downturn, with the global market cap tumbling from over $2.8 trillion to just below $2.5 trillion in a matter of weeks.

This stark decline has rippled across the sector, affecting major cryptocurrencies like Bitcoin [BTC], which has seen a 7.9% drop in the past fortnight alone.

Market analysts have been quick to identify several factors contributing to the current market conditions.

A closer look at Bitcoin revealed that it has not only dropped by nearly 8% over the last two weeks but has also continued to struggle in the last 24 hours, shedding an additional 0.1% to trade at around $65,524.

What is behind this recent downturn?

Reasons behind the crypto plunge

One of the primary factors the CryptoQuant analyst cited for the recent market decline is miner capitulation.

The CryptoQuant analyst points out a significant drop in miner revenues—by as much as 55%—has forced miners to offload Bitcoin to cover operational costs.

Source: CryptoQuant

This increase in Bitcoin moving from miners’ wallets to exchanges often precedes a price drop, as the market absorbs the added selling pressure.

Additionally, the lack of new issuances of major stablecoins such as USDT and USDC has contributed to reduced liquidity in the market.

Normally, new issuances signify fresh capital entering the market, bolstering trading volumes and supporting price levels.

Source: CryptoQuant

However, with stablecoin issuances stalling, there’s less new money to counteract selling pressures, leading to increased volatility and price declines.

Source: CryptoQuant

Another significant pressure point comes from the outflows observed in major cryptocurrency exchange-traded funds (ETFs).

Notable withdrawals, such as the over 1,384 BTC pulled from Fidelity on the 17th of June, exemplify the selling pressures that weigh heavily on Bitcoin prices.

These withdrawals reflect a broader sentiment of caution among crypto investors, particularly in response to the uncertain macroeconomic landscape.

The selling behavior is not isolated to institutional investors; it extends to short-term holders as well.

The Spent Output Profit Ratio (SOPR) for this group has not reached the highs typical of market peaks, suggesting that we are not at a cycle top yet.

Instead, we’re seeing a market still dominated by long-term holders, providing a strong support level that could temper a further crypto drop.

Looking ahead

Despite the current downturn, there are indicators that the market might be nearing a bottom.

Another CryptoQuant analyst, Julio Monero, highlighted on the X (formerly Twitter) platform that Bitcoin has fallen below key short-term support levels, potentially indicating a further drop to around $60,000.

Source: CryptoQuant

Factors such as subdued activity from traders and large investors, coupled with limited liquidity from stablecoins and diminished U.S. investor interest, are currently dampening crypto market dynamics.

Further examination using IntoTheBlock’s data revealed a notable uptick in Bitcoin transactions exceeding $100,000, signaling increased activity from large-scale investors, which could foreshadow a shift in market momentum.

Source: IntoTheBlock

Prominent crypto analyst Ali, analyzing Bitcoin’s historical price trends, suggested that if the current market cycle follows previous patterns, we might not see a peak until late 2024 or 2025.

Source: Ali Charts on X

Read Bitcoin’s [BTC] Price Prediction 2024-2025

This analysis was shared alongside a chart illustrating Bitcoin’s performance from its most recent cycle low.

Meanwhile, according to AMBCrypto’s recent report, regardless of all these downturns, we are still in a crypto bull market.

how can i get generic clomiphene can i buy cheap clomid without dr prescription can you get generic clomiphene without rx how to buy clomiphene price cost clomiphene without a prescription can you get cheap clomid without rx buy cheap clomiphene no prescription

The thoroughness in this piece is noteworthy.

I’ll certainly bring back to read more.

generic zithromax – buy tetracycline online order metronidazole 400mg generic

buy generic motilium – order cyclobenzaprine without prescription order generic flexeril 15mg

inderal 20mg ca – order plavix 75mg without prescription methotrexate 2.5mg without prescription

amoxicillin sale – combivent 100 mcg for sale buy ipratropium paypal

order zithromax 250mg sale – bystolic without prescription bystolic 5mg canada

augmentin for sale online – atbioinfo buy ampicillin online

buy esomeprazole 40mg online cheap – nexiumtous buy esomeprazole 20mg capsules

order coumadin 5mg pills – coumamide buy generic cozaar 50mg

buy mobic 7.5mg online cheap – https://moboxsin.com/ order meloxicam 7.5mg without prescription

buy prednisone 20mg online – aprep lson generic deltasone 5mg

buy cheap generic ed pills – fastedtotake.com otc ed pills that work

brand amoxicillin – amoxil price amoxicillin cost

diflucan sale – flucoan order diflucan generic

escitalopram generic – https://escitapro.com/# buy escitalopram 20mg pills

buy cenforce 100mg for sale – https://cenforcers.com/ buy generic cenforce

cialis professional ingredients – super cialis para que sirve las tabletas cialis tadalafil de 5mg

zantac oral – purchase ranitidine for sale purchase ranitidine generic