- Bitwise CIO predicts $15 billion inflow into Ethereum ETFs within 18 months.

- Ethereum ETFs expected to attract significant institutional investment, bolstering ETH’s market position.

Anticipation for the launch of Ethereum [ETH] ETFs has reached a fever pitch, with many experts speculating about potential launch dates. Industry analysts are increasingly confident that ETFs could debut as soon as mid-July.

Recent developments suggest that multiple applicants will submit their amended S-1 forms by 8th July, as reported by Bloomberg.

Nate Geraci, president of The ETF Store, indicated that final approvals could be expected by 12th July, potentially setting the stage for a launch during the week of 15th July.

Ethereum ETFs to see $15 billion inflows?

Bitwise’s CIO, Matt Hougan, has expressed confidence in Ethereum’s appeal to institutional investors, a sentiment not universally shared until now.

In a video with analyst Scott Melker, the CIO reveals that the observations from European and Canadian markets, where Ethereum consistently attracts substantial investment, reinforce his optimistic outlook for similar success in the U.S. market.

Hougan’s analysis extends beyond mere speculation, delving into strategic conversations with leaders from major financial institutions.

One such dialogue with a $100+ billion advisory firm revealed a readiness to diversify into Ethereum upon the launch of an official ETF, highlighting the broader financial community’s growing comfort with cryptocurrency as a legitimate asset class.

Furthermore, Hougan challenges the prevailing narrative of high correlation between cryptocurrencies and traditional financial markets.

He argues that, aside from brief periods of alignment due to extraordinary economic measures like those recently seen, cryptocurrencies generally operate independently of traditional markets.

This independence is crucial for investors seeking diversification and risk-adjusted returns.

Ethereum’s struggle: Market downturn and surging liquidations

Amid the broader market downturn, Ethereum’s performance mirrors the decline seen in Bitcoin, with ETH dropping approximately 6.2% in the last 24 hours to a current trading price of $3,139.

This significant decrease has led to considerable losses for many traders.

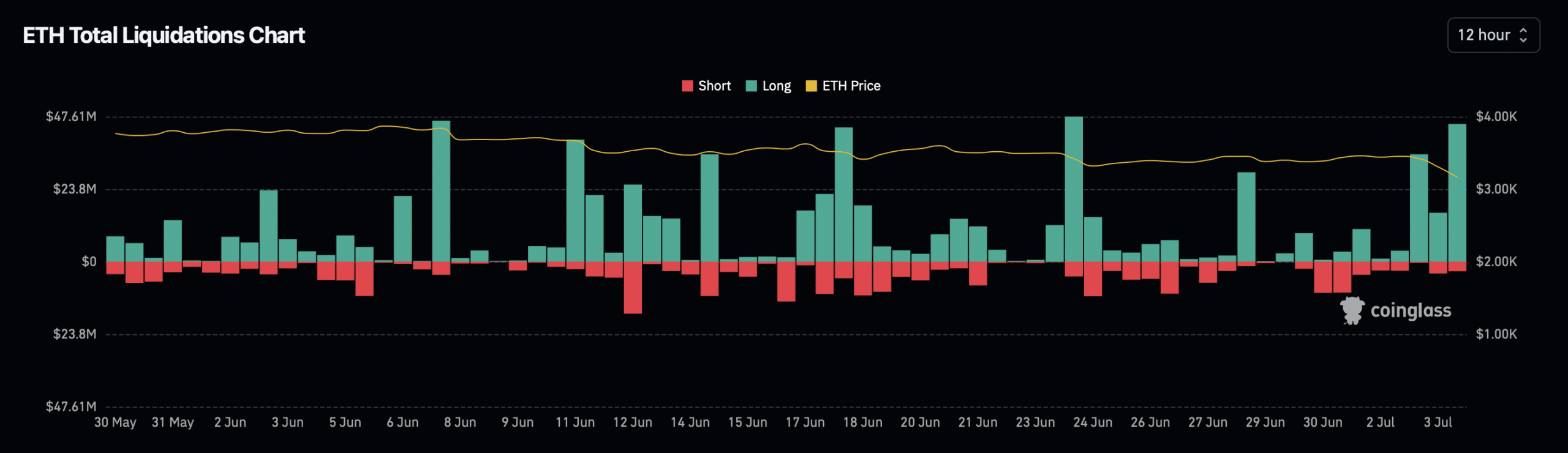

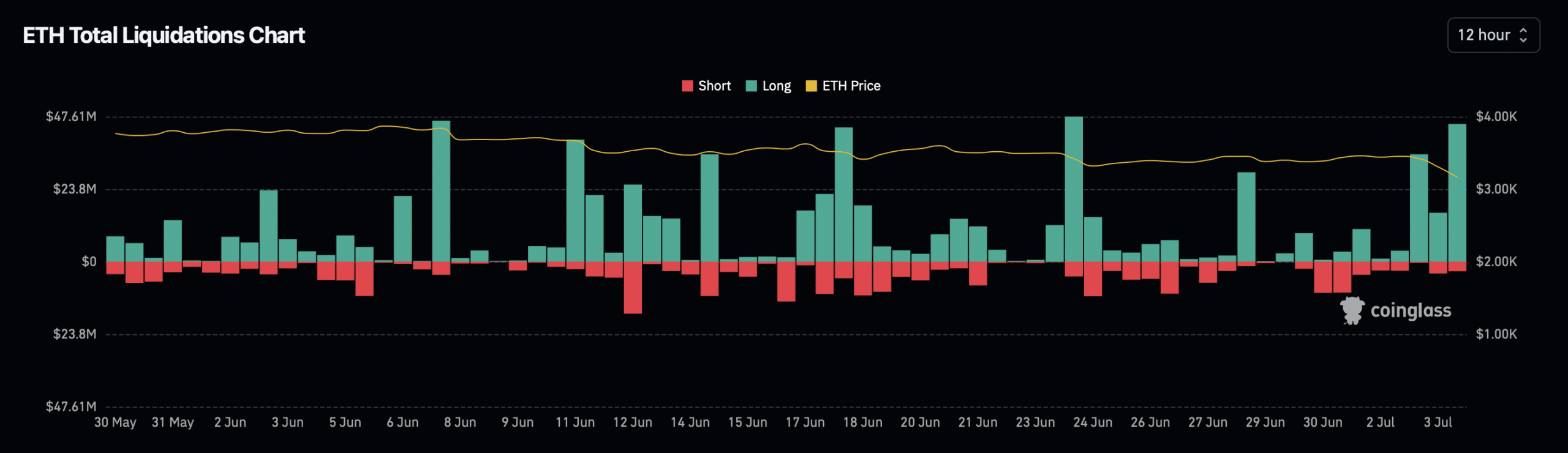

Source: Coinglass

Data from Coinglass reveals that over the past 24 hours, 113,506 traders have been liquidated, contributing to total liquidations of $317.34 million.

Of this, Ethereum-related liquidations account for about $76.51 million, predominantly in long positions, amounting to $70.16 million compared to $6.35 million in shorts.

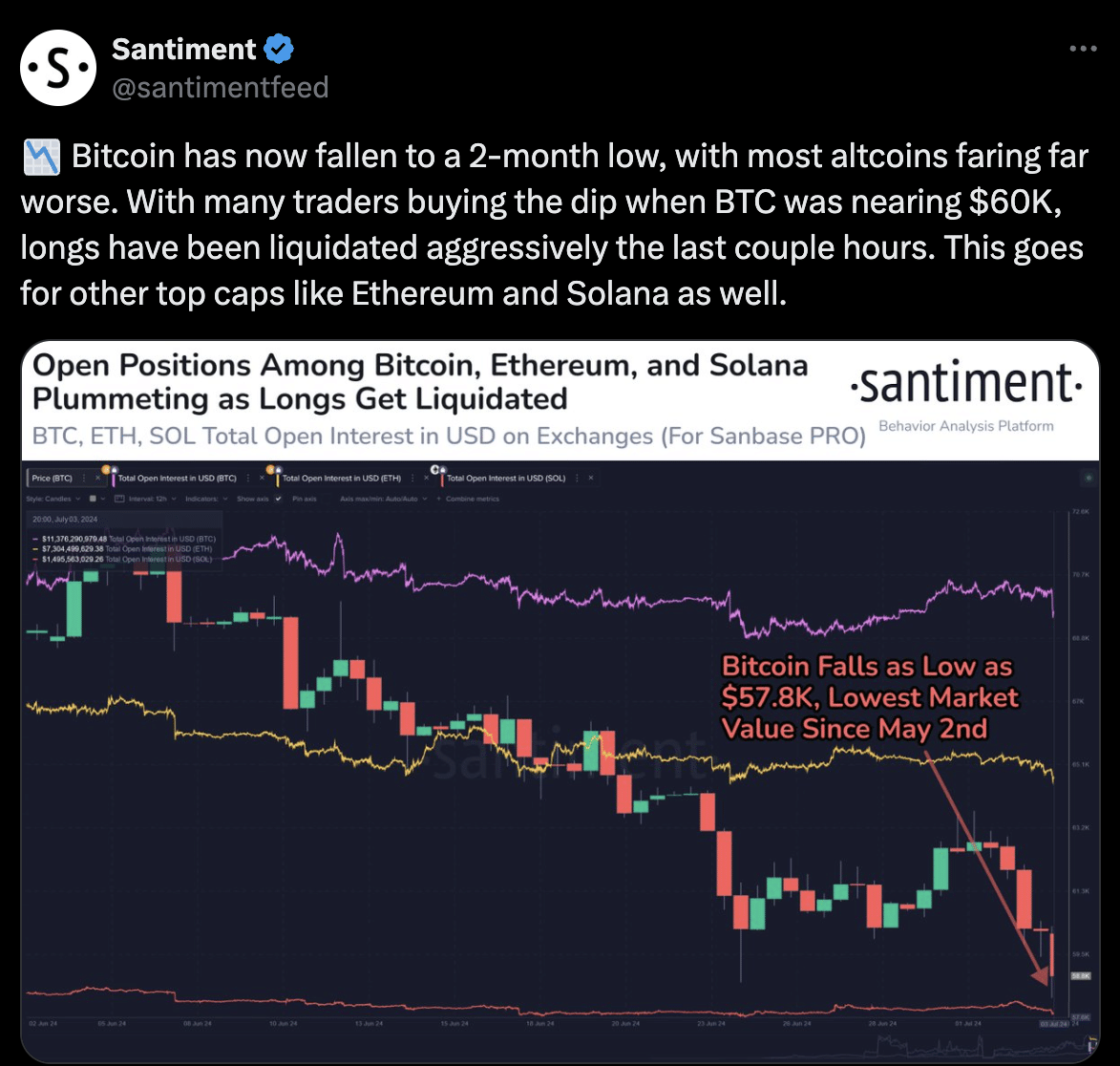

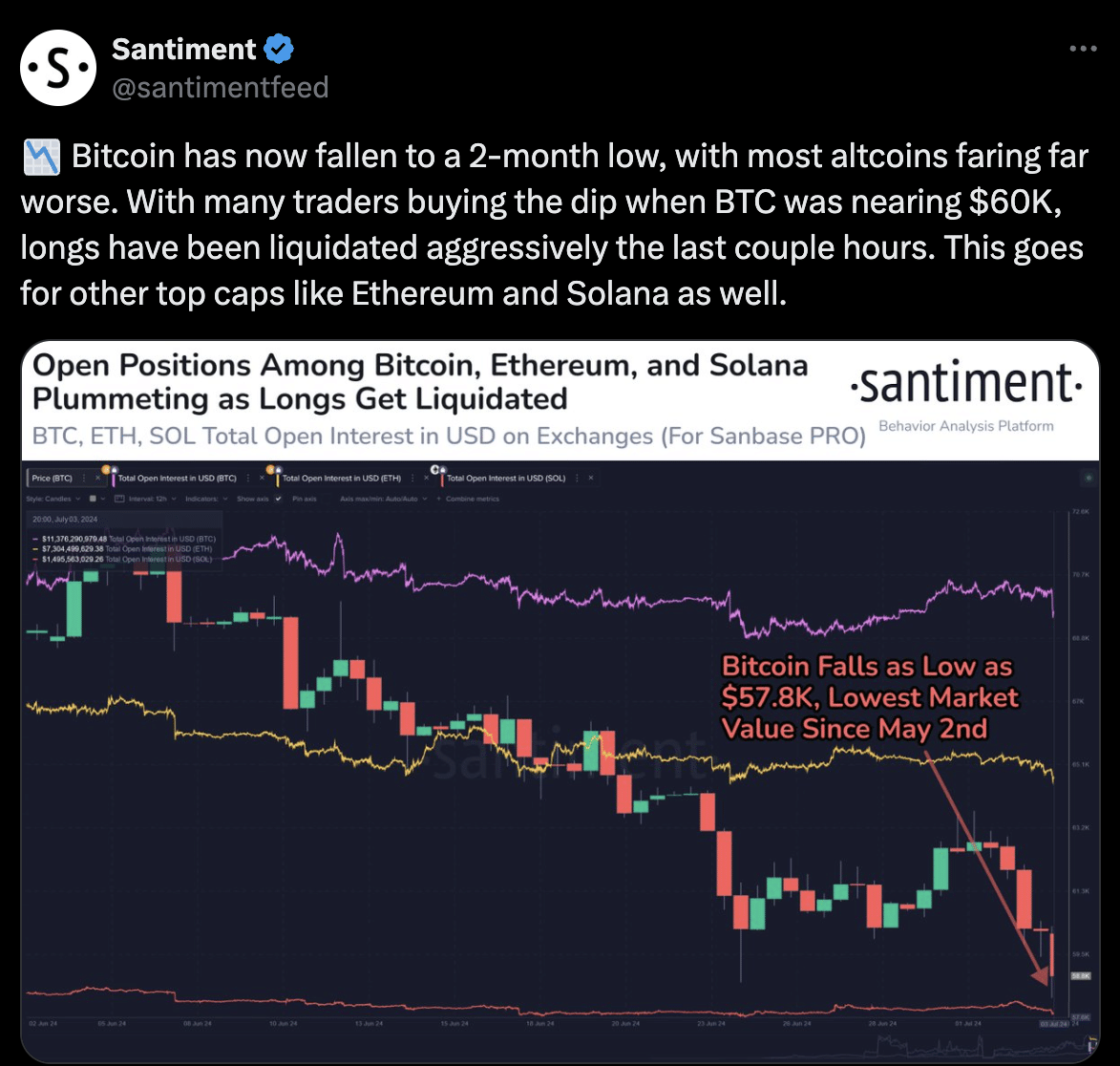

Further exacerbating the situation, market intelligence platform Santiment has reported a downturn in Ethereum’s open interest.

Source: Santiment

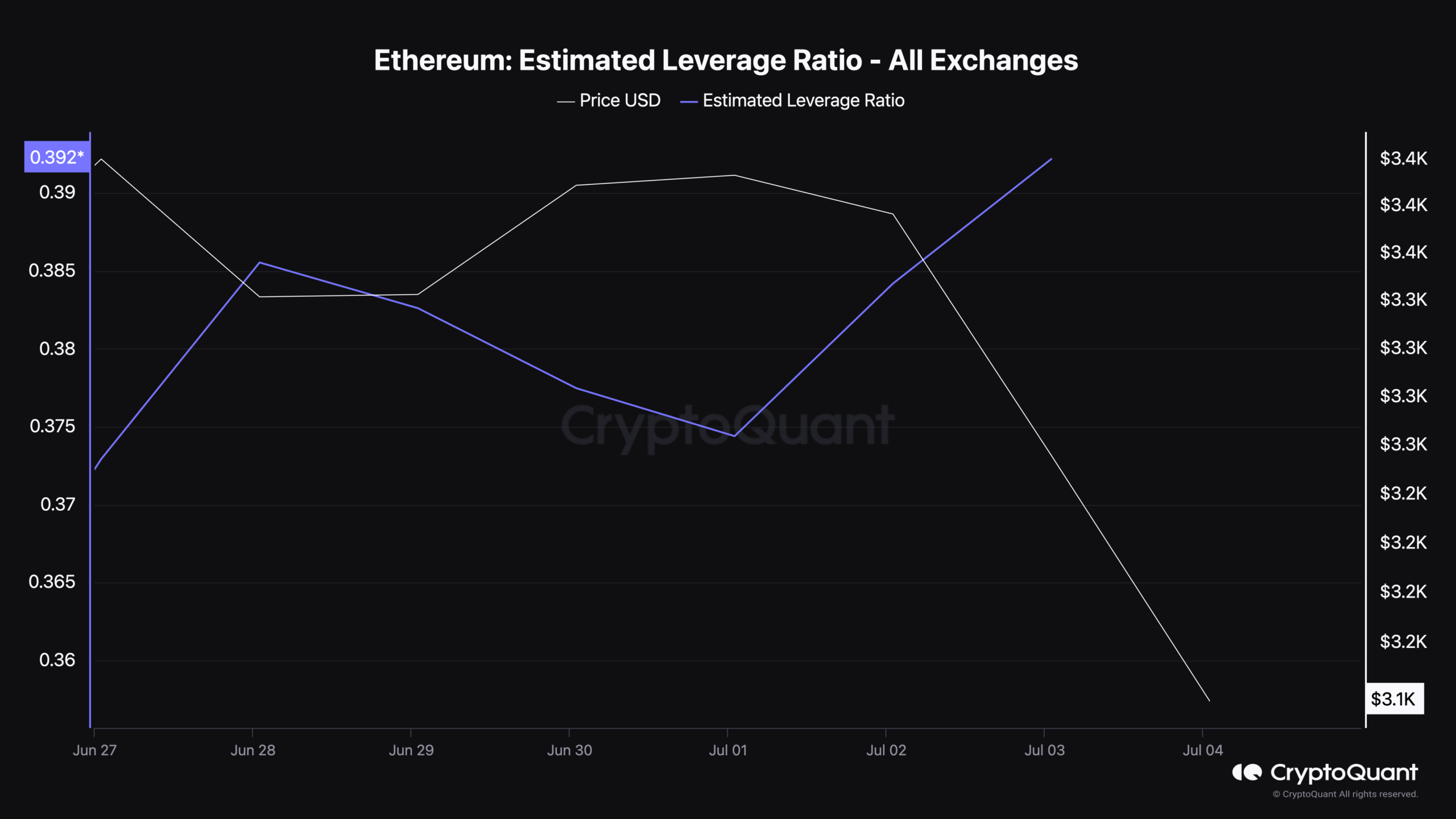

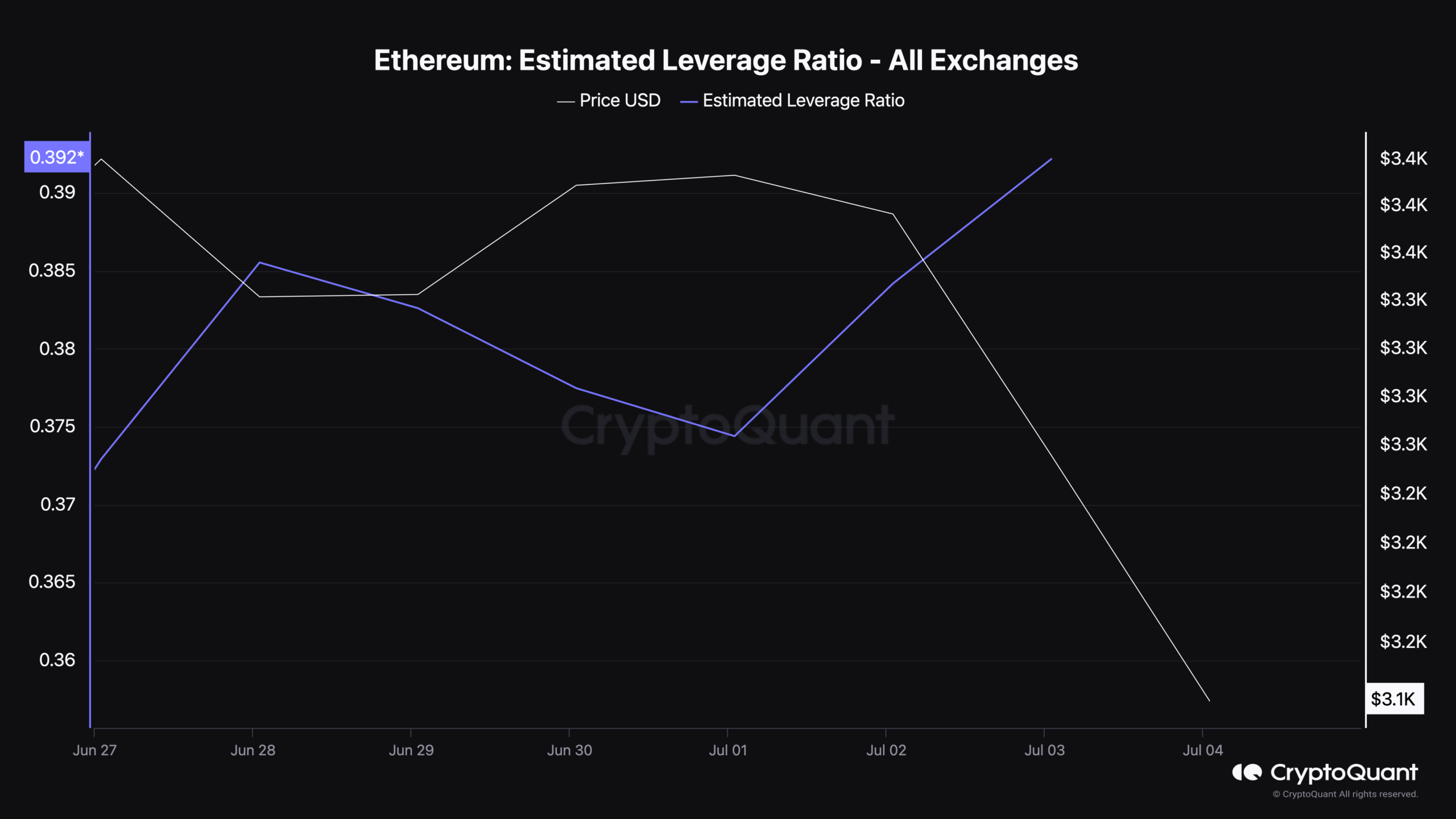

Additionally, data from CryptoQuant highlights that Ethereum’s Estimated Leverage Ratio across all exchanges has risen to a notable 0.392. This indicates an increase in leveraged positions relative to the asset’s market cap which could suggest heightened risk of volatility or further liquidations.

Source: CryptoQuant

Read Ethereum’s [ETH] Price Prediction 2024-25

Despite these challenges, not all indicators for Ethereum are bearish.

AMBCrypto has reported a recent uptick in Ethereum’s decentralized application (dApp) volume, suggesting some areas of the Ethereum ecosystem continue to see robust activity.

- Bitwise CIO predicts $15 billion inflow into Ethereum ETFs within 18 months.

- Ethereum ETFs expected to attract significant institutional investment, bolstering ETH’s market position.

Anticipation for the launch of Ethereum [ETH] ETFs has reached a fever pitch, with many experts speculating about potential launch dates. Industry analysts are increasingly confident that ETFs could debut as soon as mid-July.

Recent developments suggest that multiple applicants will submit their amended S-1 forms by 8th July, as reported by Bloomberg.

Nate Geraci, president of The ETF Store, indicated that final approvals could be expected by 12th July, potentially setting the stage for a launch during the week of 15th July.

Ethereum ETFs to see $15 billion inflows?

Bitwise’s CIO, Matt Hougan, has expressed confidence in Ethereum’s appeal to institutional investors, a sentiment not universally shared until now.

In a video with analyst Scott Melker, the CIO reveals that the observations from European and Canadian markets, where Ethereum consistently attracts substantial investment, reinforce his optimistic outlook for similar success in the U.S. market.

Hougan’s analysis extends beyond mere speculation, delving into strategic conversations with leaders from major financial institutions.

One such dialogue with a $100+ billion advisory firm revealed a readiness to diversify into Ethereum upon the launch of an official ETF, highlighting the broader financial community’s growing comfort with cryptocurrency as a legitimate asset class.

Furthermore, Hougan challenges the prevailing narrative of high correlation between cryptocurrencies and traditional financial markets.

He argues that, aside from brief periods of alignment due to extraordinary economic measures like those recently seen, cryptocurrencies generally operate independently of traditional markets.

This independence is crucial for investors seeking diversification and risk-adjusted returns.

Ethereum’s struggle: Market downturn and surging liquidations

Amid the broader market downturn, Ethereum’s performance mirrors the decline seen in Bitcoin, with ETH dropping approximately 6.2% in the last 24 hours to a current trading price of $3,139.

This significant decrease has led to considerable losses for many traders.

Source: Coinglass

Data from Coinglass reveals that over the past 24 hours, 113,506 traders have been liquidated, contributing to total liquidations of $317.34 million.

Of this, Ethereum-related liquidations account for about $76.51 million, predominantly in long positions, amounting to $70.16 million compared to $6.35 million in shorts.

Further exacerbating the situation, market intelligence platform Santiment has reported a downturn in Ethereum’s open interest.

Source: Santiment

Additionally, data from CryptoQuant highlights that Ethereum’s Estimated Leverage Ratio across all exchanges has risen to a notable 0.392. This indicates an increase in leveraged positions relative to the asset’s market cap which could suggest heightened risk of volatility or further liquidations.

Source: CryptoQuant

Read Ethereum’s [ETH] Price Prediction 2024-25

Despite these challenges, not all indicators for Ethereum are bearish.

AMBCrypto has reported a recent uptick in Ethereum’s decentralized application (dApp) volume, suggesting some areas of the Ethereum ecosystem continue to see robust activity.

generic clomid c10m1d how to get cheap clomiphene price cost clomid without insurance can you buy clomid for sale cost of generic clomiphene online clomiphene price at clicks can i purchase generic clomid without a prescription

I couldn’t resist commenting. Warmly written!

More articles like this would remedy the blogosphere richer.

azithromycin 250mg pills – order ciprofloxacin online order metronidazole 400mg generic

cost semaglutide 14 mg – order periactin 4mg generic cyproheptadine 4 mg generic

buy domperidone pills – order motilium for sale flexeril price

buy amoxiclav without prescription – https://atbioinfo.com/ acillin sale

order esomeprazole 40mg sale – anexa mate cost nexium

order coumadin 2mg online – https://coumamide.com/ order hyzaar for sale

mobic usa – https://moboxsin.com/ mobic 7.5mg cost

order prednisone 40mg without prescription – allergic reactions buy prednisone 5mg online

can i buy ed pills over the counter – https://fastedtotake.com/ ed pills where to buy

buy amoxil cheap – combamoxi.com where can i buy amoxil

fluconazole without prescription – order diflucan 100mg online diflucan 100mg us

order cenforce 50mg pills – https://cenforcers.com/ cenforce where to buy

cialis prostate – https://ciltadgn.com/ cialis canada prices

cheap cialis pills – https://strongtadafl.com/ difference between tadalafil and sildenafil

I am in point of fact thrilled to coup d’oeil at this blog posts which consists of tons of of use facts, thanks towards providing such data. neurontin 400 efectos secundarios

50 mg of sildenafil – can buy viagra rite aid can buy viagra rite aid

This website positively has all of the low-down and facts I needed to this case and didn’t know who to ask. https://ursxdol.com/levitra-vardenafil-online/

This is a keynote which is in to my heart… Diverse thanks! Quite where can I notice the connection details an eye to questions? https://buyfastonl.com/isotretinoin.html

This is the kind of serenity I take advantage of reading. https://prohnrg.com/product/rosuvastatin-for-sale/