- Data showed that the BTC max pain was set at around $61,000.

- BTC was trading in the $53,000 price range.

Bitcoin [BTC] was on the verge of experiencing a significant expiration of positions in its derivatives market.

This upcoming event was closely tied to recent price trend fluctuations and could lead to increased market volatility.

The anticipated expiration may influence market dynamics significantly as traders adjust their positions in response to the evolving price landscape.

Bitcoin prepares for options expiration

According to AMBCrypto’s analysis of Bitcoin options, approximately 18,000 Bitcoin options contracts, with a notional value of around $1 billion, are scheduled to expire on the 5th of July.

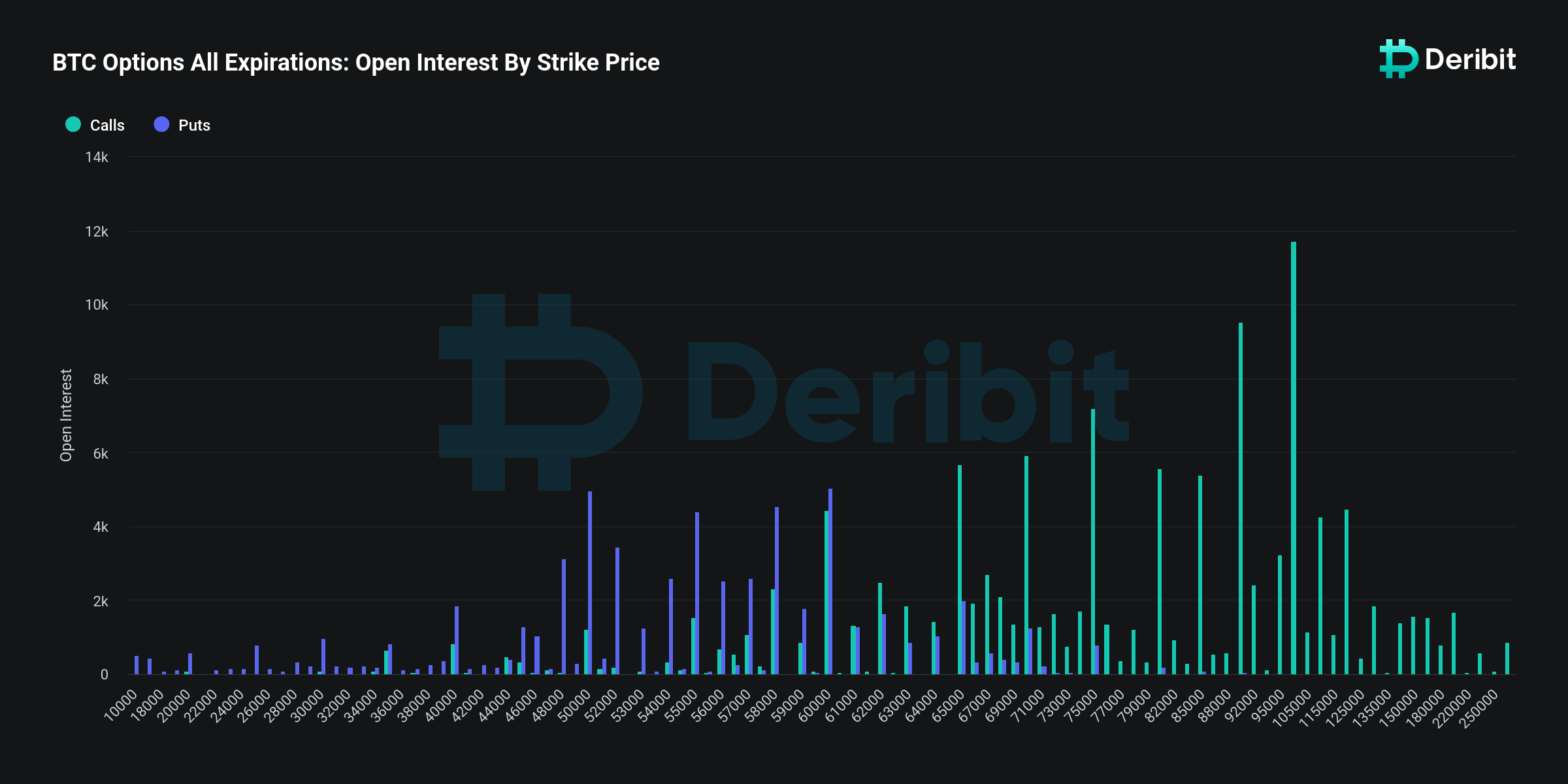

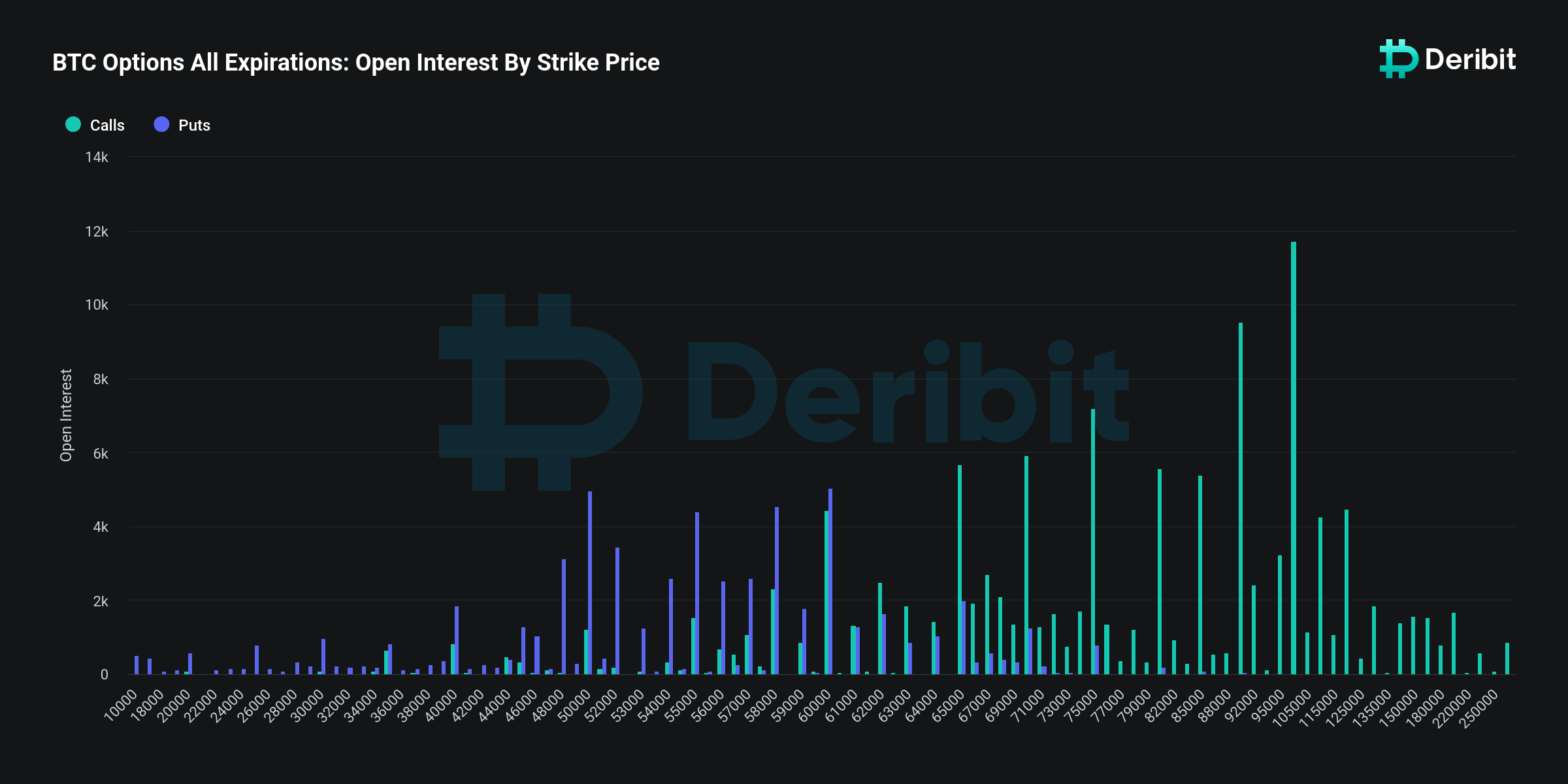

The current BTC derivatives market has a put/call ratio of 0.65, indicating that nearly twice as many call (long) contracts are expiring compared to put (short) contracts.

Source: Deribit

Also, the max pain point, where the greatest losses would occur, is set at $61,500. This level is considerably higher than the current spot prices, especially following this week’s substantial market downturn.

Furthermore, a significant amount of Open Interest remained at higher strike prices. Data from Deribit showed $532 million at a strike price of $90,000 and $665 million in open interest (OI) at $100,000.

Additionally, whale sell-offs have been exerting additional downward pressure on the market trend, intensifying the impact on prices.

More Bitcoin options could expire

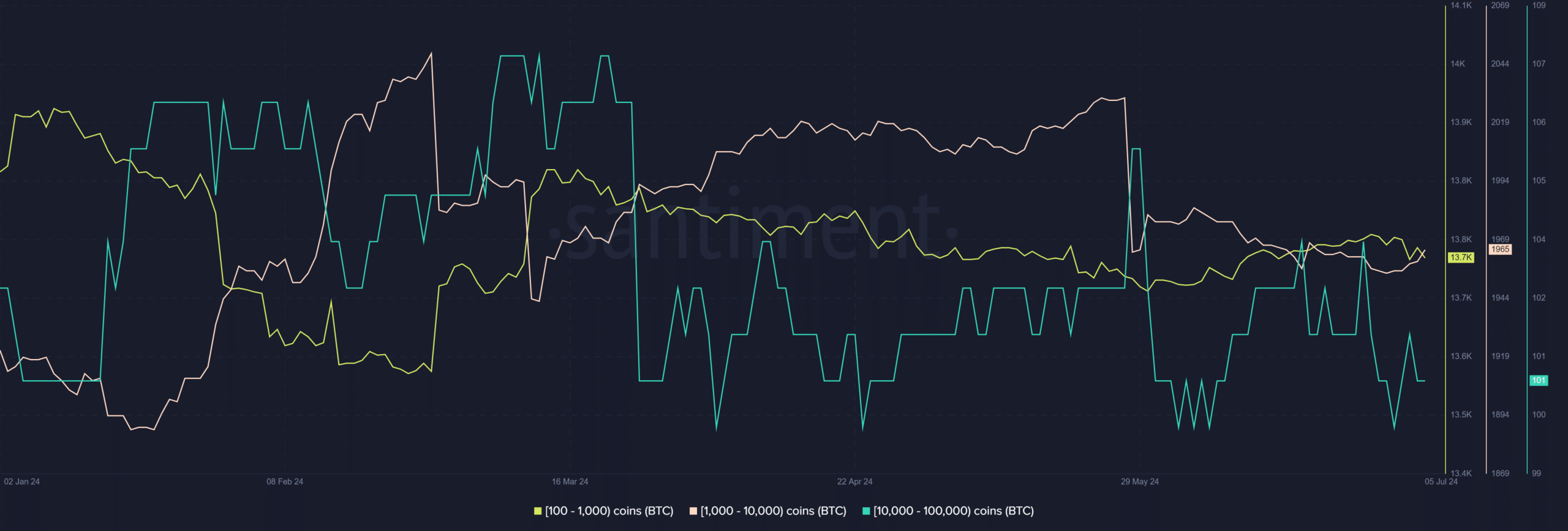

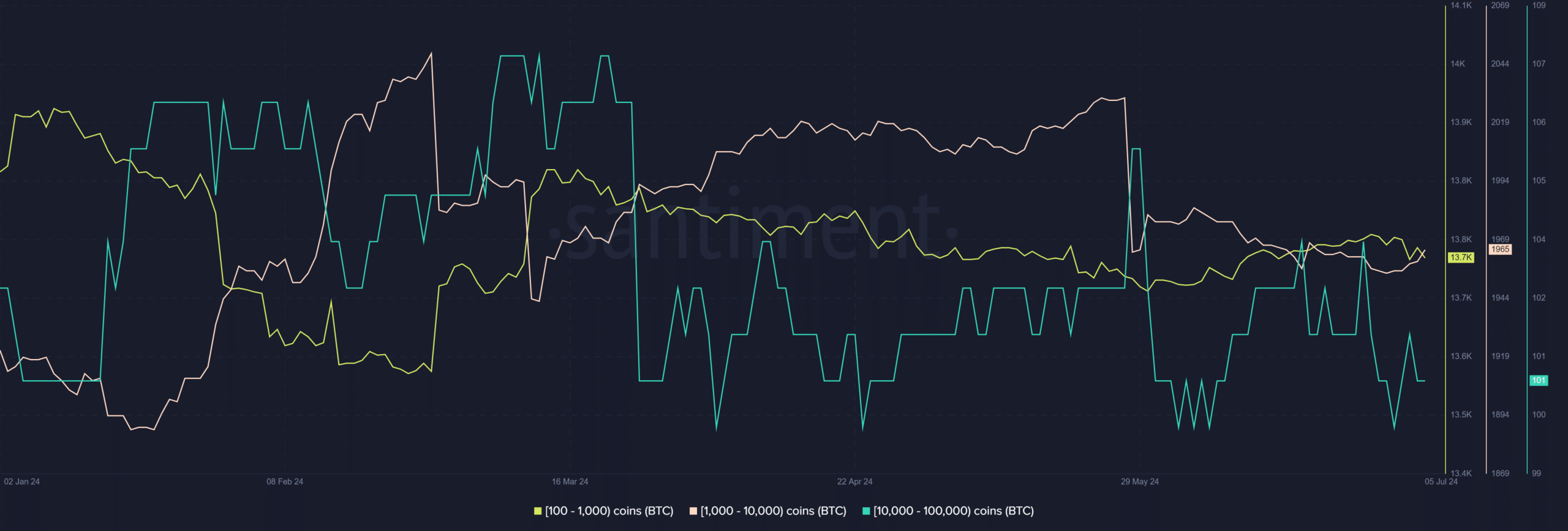

AMBCrypto’s look at of Bitcoin’s supply distribution indicated that whales have been offloading their holdings recently.

Specifically, wallets holding between 100 to 1,000 BTC and those holding 10,000 to 100,000 BTC have experienced notable declines in the last few days.

Source: Santiment

These whale wallets have collectively engaged in a sell-off involving millions of dollars worth of Bitcoin.

Currently, the count of wallets in the 100-1,000 BTC range stood at approximately 13,700, while those in the 10,000 to 100,000 BTC range numbered around 101.

This significant reduction in holdings reflected a broader sentiment shift among major Bitcoin investors.

Bitcoin falls into the oversold zone

AMBCrypto’s examination of Bitcoin’s Relative Strength Index (RSI) on the daily time frame price chart revealed it was oversold. The chart showed it was below 30 as of this writing.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Furthermore, Bitcoin traded at around $53,300, trending below its long moving average (blue line). Originally serving as long-term support, this blue line has become a resistance level due to recent price declines.

Source: TradingView

This shift reflects the current bearish market sentiment. It plays a significant role in the dynamics around the large volume of Bitcoin options expiring today, likely influencing trading strategies and market expectations.

- Data showed that the BTC max pain was set at around $61,000.

- BTC was trading in the $53,000 price range.

Bitcoin [BTC] was on the verge of experiencing a significant expiration of positions in its derivatives market.

This upcoming event was closely tied to recent price trend fluctuations and could lead to increased market volatility.

The anticipated expiration may influence market dynamics significantly as traders adjust their positions in response to the evolving price landscape.

Bitcoin prepares for options expiration

According to AMBCrypto’s analysis of Bitcoin options, approximately 18,000 Bitcoin options contracts, with a notional value of around $1 billion, are scheduled to expire on the 5th of July.

The current BTC derivatives market has a put/call ratio of 0.65, indicating that nearly twice as many call (long) contracts are expiring compared to put (short) contracts.

Source: Deribit

Also, the max pain point, where the greatest losses would occur, is set at $61,500. This level is considerably higher than the current spot prices, especially following this week’s substantial market downturn.

Furthermore, a significant amount of Open Interest remained at higher strike prices. Data from Deribit showed $532 million at a strike price of $90,000 and $665 million in open interest (OI) at $100,000.

Additionally, whale sell-offs have been exerting additional downward pressure on the market trend, intensifying the impact on prices.

More Bitcoin options could expire

AMBCrypto’s look at of Bitcoin’s supply distribution indicated that whales have been offloading their holdings recently.

Specifically, wallets holding between 100 to 1,000 BTC and those holding 10,000 to 100,000 BTC have experienced notable declines in the last few days.

Source: Santiment

These whale wallets have collectively engaged in a sell-off involving millions of dollars worth of Bitcoin.

Currently, the count of wallets in the 100-1,000 BTC range stood at approximately 13,700, while those in the 10,000 to 100,000 BTC range numbered around 101.

This significant reduction in holdings reflected a broader sentiment shift among major Bitcoin investors.

Bitcoin falls into the oversold zone

AMBCrypto’s examination of Bitcoin’s Relative Strength Index (RSI) on the daily time frame price chart revealed it was oversold. The chart showed it was below 30 as of this writing.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Furthermore, Bitcoin traded at around $53,300, trending below its long moving average (blue line). Originally serving as long-term support, this blue line has become a resistance level due to recent price declines.

Source: TradingView

This shift reflects the current bearish market sentiment. It plays a significant role in the dynamics around the large volume of Bitcoin options expiring today, likely influencing trading strategies and market expectations.

![What Is Asset Tokenization? Types, Why It Matters Now [2025]](https://coininsights.com/wp-content/uploads/2025/05/asset_tokenization-360x180.png)

can i order clomid without insurance order cheap clomid no prescription how can i get cheap clomid without dr prescription order clomid pill can i purchase clomid without rx where can i buy generic clomiphene without prescription get clomid without rx

This website absolutely has all of the information and facts I needed there this participant and didn’t positive who to ask.

This is the stripe of topic I have reading.

rybelsus 14mg sale – purchase cyproheptadine pill buy generic periactin

order domperidone online – order sumycin 500mg generic cyclobenzaprine 15mg ca

buy generic amoxil over the counter – buy amoxil without prescription ipratropium uk